The Seven Realms Fund is intended to cater to the currently un-served financial needs of all the developing and frontier financial institutions of the world.

The fund, a Specialized Investment Fund (SIF), is a legally designated fund based on the Luxembourgish fund law of 13th February 2007. The Seven Realms fund would be created to be considered a self managed fund with virtually all primary operations provided by subcontracted firms. Marketing by the Seven Realms Group and then separate administrative, transfer and custodial services, among others, would be provided by various financial services company such as Standard Chartered Group.

The Luxembourg based marketing company and legally described promoter of the fund, The Seven Realms Group would initially be owned eighty percent (80%) by the Seven Realms Foundation. This Foundation will be dedicated to four primary goals. The first two would be the building of water based and transportation based infrastructure worldwide. The third would be dedicated to the planting of trees, shrubs and preserving wetlands in as many spots of the planet as possible. The fourth function of the foundation would be to provide restoration assistance to those areas suffering from natural disasters.

Twenty percent (20%) of the Seven Realms Group will be owned by the founders, early management and financial investors of the Group. As the dividends to the Foundation and the Group shall be determined after the expenses of the marketing and management expenses of the fund.

It is envisioned that the revenue and thus profits and dividends of the Seven Realms Group and Seven Realms Foundation would be derived from all monies remaining from the management fees revenue of the Seven Realms Fund after the administrative, transfer, custodial and other expenses were paid to the subcontracting support companies.

The fund, a Specialized Investment Fund (SIF), is a legally designated fund based on the Luxembourgish fund law of 13th February 2007. The Seven Realms fund would be created to be considered a self managed fund with virtually all primary operations provided by subcontracted firms. Marketing by the Seven Realms Group and then separate administrative, transfer and custodial services, among others, would be provided by various financial services company such as Standard Chartered Group.

The Luxembourg based marketing company and legally described promoter of the fund, The Seven Realms Group would initially be owned eighty percent (80%) by the Seven Realms Foundation. This Foundation will be dedicated to four primary goals. The first two would be the building of water based and transportation based infrastructure worldwide. The third would be dedicated to the planting of trees, shrubs and preserving wetlands in as many spots of the planet as possible. The fourth function of the foundation would be to provide restoration assistance to those areas suffering from natural disasters.

Twenty percent (20%) of the Seven Realms Group will be owned by the founders, early management and financial investors of the Group. As the dividends to the Foundation and the Group shall be determined after the expenses of the marketing and management expenses of the fund.

It is envisioned that the revenue and thus profits and dividends of the Seven Realms Group and Seven Realms Foundation would be derived from all monies remaining from the management fees revenue of the Seven Realms Fund after the administrative, transfer, custodial and other expenses were paid to the subcontracting support companies.

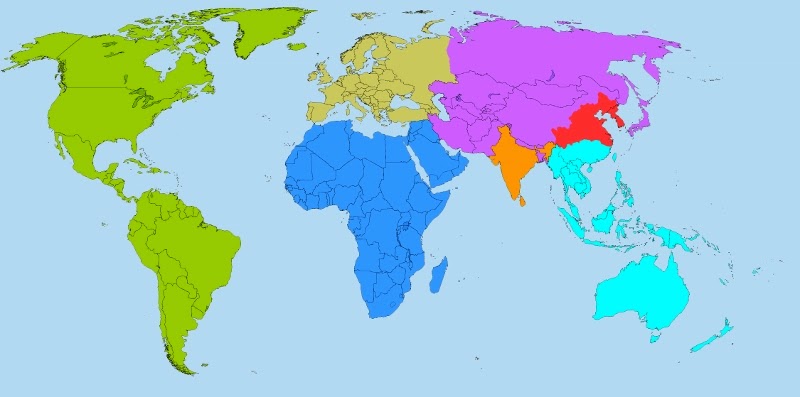

This SIF international oriented mutual fund would hold common stocks, preferred stocks, ETF's and other mutual funds, corporate bonds, government bonds and an international basket of currencies. These would be securities quoted on an established and recognized exchanges or markets throughout the world. The balance of the fund, between these various classes of securities and currencies would also be guided by balancing fund assets evenly among seven (7) pre-determined areas of the world. The Seven Realms.

As with other pre-authorized mutual funds the assets of the SIF would be acquired by exchanging unit shares of the SIF for assets presented to the fund. The SIF would also accept currencies the world over in exchange for unit shares. After the initial creation, the SIF would be opened to financial institutions, government entities and "informed investors", as determined by Luxembourg law, worldwide. It is envisioned that the early marketing and thus investors to the fund shall be banks, central banks and other financial institutions based in what are described as economically developing and frontier nations of the world.

The SIF would have a designated administration company (perhaps Standard Chartered Group or else European Fund Administration S.A. of Luxembourg, www.efa.eu) to determine it's Net Asset Value (NAV) at the end of each world trading day. This NAV value would then be the price at which all transactions of buying or redeeming the fund units would be done during the next business day. The SIF would also require both a Custodial Bank and a transfer agent registered in Luxembourg and around the world. This would, again, most likely be an organization such as Standard Chartered from its offices in Luxembourg and then worldwide. ( http://bit.ly/L85zZw )

The SIF would have a designated administration company (perhaps Standard Chartered Group or else European Fund Administration S.A. of Luxembourg, www.efa.eu) to determine it's Net Asset Value (NAV) at the end of each world trading day. This NAV value would then be the price at which all transactions of buying or redeeming the fund units would be done during the next business day. The SIF would also require both a Custodial Bank and a transfer agent registered in Luxembourg and around the world. This would, again, most likely be an organization such as Standard Chartered from its offices in Luxembourg and then worldwide. ( http://bit.ly/L85zZw )

The success of the fund and its purpose would be best facilitated if the fund were of some considerable financial and geographic diversification. Think of it as sort of a sovereign world fund for the entire world. For one to appreciate the true idea of the fund, the foundation and the management company one must think in terms of the fund holding assets from virtually every nation in the world and with total asset values in the multiple trillions of dollars.

The basic foundation of the fund would be in its size and geographic diversity. The larger the assets of the fund and the more diverse the better its ability to help stabilize world currency and interest rate fluctuations. The true success of the fund would be when the price of a single Fund unit is compared with the price of any major or minor currency worldwide. Thus a unit price would be compared to and quoted against the price of Dollars, Euros, Yen etc. It should be this comparison, as opposed to comparison with the value of other mutual funds that is the goal of the fund. In the same manner every entity owning units in the fund could then trade the units back into a currency or currencies of choice.

As the fund is meant to hold securities for long term it would not be considered by any of the countries it invested in as "hot money". It would also attempt to eventually hold every viably traded common stock worldwide in some amount or other. The same would be of many corporate bonds, government bonds from many countries, states and municipalities and again also virtually all world currencies in some amount. In this way every unit of the SIF Seven Realms fund would be backed by marketable, quoted and tangible financial assets. This would make the value of each unit of the fund correspond to the NAV of the fund and not market forces creating a value by trading against other currencies or assets based upon market forces of supply and demand.

Thus countries such as China and Russia could trade US treasuries for units in the fund. The same is true of all countries, banks, insurance companies and eventually individual citizens in countries where this was allowed by law.

The fund does not intend to seek nor intend to pursue a goal of fast appreciation of NAV. It is intended more to provide stability and alternatives to currencies, financial institution credit rating enhancement and individual investment opportunities worldwide. Providing this financial product would then facilitate more long term investment in all frontier, developing and developed markets.